Members of the Piedmont Division,

We have been working diligently over the past several years to achieve status as a 501(c)3 organization under IRS code. Completing this process will allow doners to take a tax deduction for donations to our group. Both the NMRA National and Region operations are 501(c)3 organizations and this is something that the two previous Superintendents have been working on.

We are closer now than we have been before, but the IRS has made it clear that our Bylaws require modification in order to meet their requirements. The IRS has also noted that our change must be made by their set deadline of September 12th, 2022.

The proposed change to our Bylaws affects only Article XI, Non-Profit Organization. The Board of Directors understands that we are working to complete this change in our Bylaws using a very quick process. All of the Board members, who have expressed an opinion, has voted yes, what remains is to publish the proposed change for review by the membership, that change is included in this email notification as well as publication on our website, and for the membership to vote on the change.

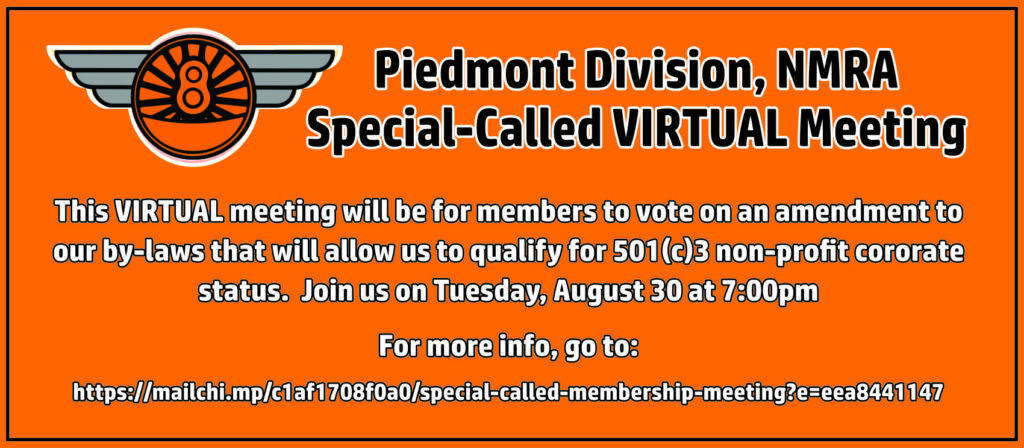

In order to vote on this change, by the September 12th deadline, there will be a Called Meeting of the General Membership:

Tuesday, August 30, 2022 at 7:00 PM in the Division’s WebEx room https://perrylamb.my.webex.com/meet/perry_lamb

This should be a short meeting, but it will allow time for questions and the vote. 2/3 of those present need to vote YES to the Bylaws change for our application to the IRS to continue.

Thank you very much and I look forward to seeing as many of you as possible on August 30.

MOTION TO AMNEND Piedmont Division Bylaws Article XI Non-Profit Corporation as follows:

Article XI. Non-Profit Corporation

The Piedmont Division, Inc. is organized exclusively for charitable, educational, literary and scientific purposes, and is registered under Section 501(c)(4) of the Internal Revenue Code, or corresponding sections of any future federal tax code. The organization has applied to be registered under Section 501(c)(3) of the Internal Revenue Code, or corresponding sections of any future federal tax code. Upon approval of said application, the organization shall be organized exclusively for charitable, educational, literary and scientific purposes within the meaning of Section 501(c)(3) of the Internal Revenue Code, or corresponding sections of any future federal tax code.

Upon the dissolution of this organization, assets shall be distributed for one or more exempt purposes within the meaning of Section 501(c)(3) of the Internal Revenue Code, or corresponding section of any future federal tax code, or shall be distributed to the federal government, or to a state or local government, for a public purpose.

BACKGROUND – WHY??

We have an IRS letter regarding our 501c3 application stating that our current Article XI wording is not sufficient to meet their requirements. We must reply by September 12. Contacting them to ask for an extension is not a viable option – they are impossible to contact. If we do not reply with this modification by then, we have to start all over, and pay another $600 filing fee. Hence we must act immediately, prior to our regular September 13 meeting.

The current wording is:

Article XI. Non-Profit Corporation

The Piedmont Division, Inc is a registered non-profit corporation organized exclusively for charitable and educational purposes under Section 501 (c) 3 or 501 (c) 4 of the Internal Revenue Code, or corresponding section of any future federal tax code. No part of the income or the assets of the Division shall inure to the benefit of any Officer, Director or Member.

Piedmont Division will be undergoing monthly scheduled maintenance on August 3rd, beginning at 10PM EST. The website will be unavailable during this time.

We apologize for any inconvenience.

This function is currently being implemented. Thank you for your patience.

As you explore the site and get familiar with how it works, we’ve setup a form to report any bugs or issues that you may encounter. Using this form will help us track and address issues more efficiently.

Thank you for your time, your feedback is invaluable and appreciated!